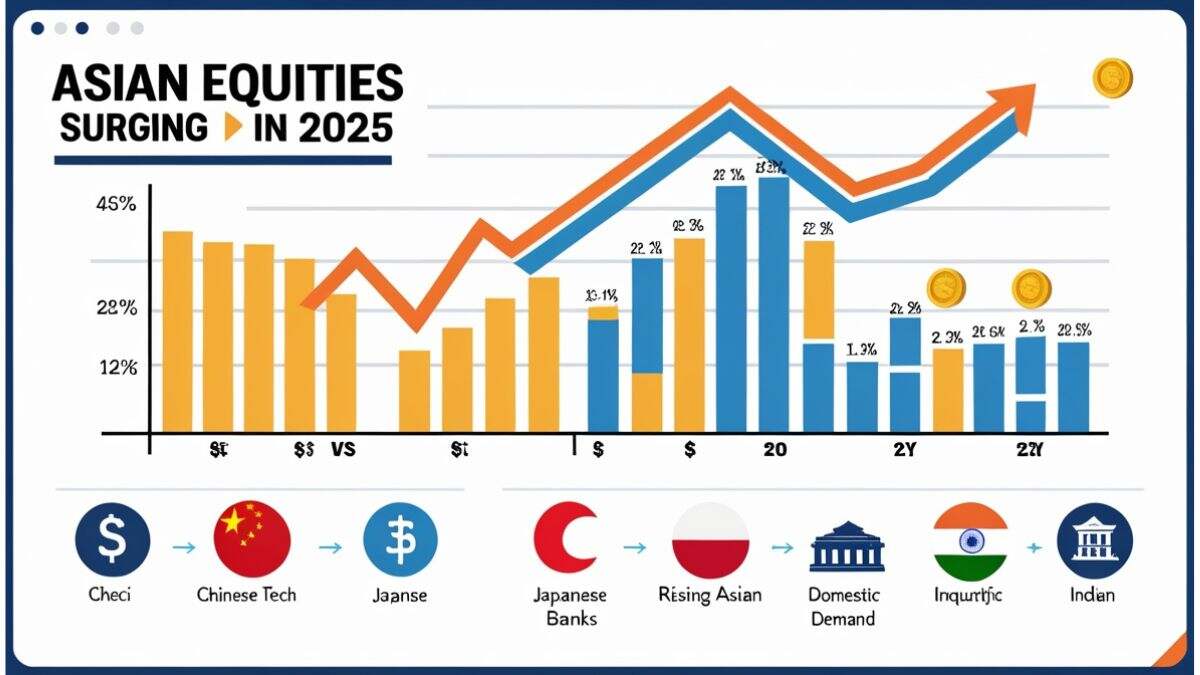

With a 22% increase this year, the MSCI Asia Pacific Index has outperformed the S&P 500 Index by almost eight percentage points, marking the largest annual outperformance since 2017.

Analysts predict that Asian equities will continue to outperform their US counterparts as a declining dollar increases the allure of a region that has benefited from lower valuations and a significant move away from American assets.

Growing indications of reducing trade tensions, particularly between the US and China, where a months-long rise seems far from finished, are also helping the region’s stocks. Although it was inevitable, the Federal Reserve’s most recent interest rate decrease strengthened a pessimistic view of the US dollar and gave Asian central banks leeway to relax policy.

Homin Lee, a senior macro analyst at Lombard Odier Singapore Ltd., said, “We are strategically optimistic on APAC equities’ relative performance in the balance of the year vs US equities.” He noted that a number of variables, including declining trade disruption, lower US interest rates, and steady commodity prices, should provide the markets a respectable background.

The MSCI Asia index is now trading at 16 times future earnings forecasts, which is less than the 23 times for the S&P 500. According to statistics provided by Bloomberg, the Hang Seng Tech Index, which surged to a four-year high last week, is now trading at around 21 times forecast profits, while the Nasdaq 100 Index is trading at 27 times.

The Fed’s rate drop last week gave Asian currencies a further lift, even though it is still unclear how quickly and how much the policy easing cycle would persist.

Options market signals indicate that traders are paying more to protect themselves against future gains in Asian currencies. For months, the region’s aggregates of risk reversals, which gauge demand for options that pay out if the currencies appreciate vs the dollar over different time periods, have been in positive territory.

According to Chang Hwan Sung, a multi-asset portfolio manager at Invesco’s investment solutions team in Hong Kong, “Given this background we are expanding our exposure to non-US stocks particularly Asian equities compared to US equities.” He noted that “US capital outflows seeking worldwide diversification and foreign currency appreciation” and a pessimistic outlook on the US dollar are the primary drivers of the choice.

Indeed, a hawkish policy shift or even an inflation-driven halt to the Fed’s rate-cut cycle would quickly deflate market optimism, and US-China relations are still at risk of worsening. Meanwhile, political unpredictabilities in Thailand, Japan, and Indonesia are also focused on.

For the time being, however, there is hope that the demand for Asian equities will continue to be high as long as US exceptionalism attracts critics.

“Although Asia offers distinct investment prospects, the U.S. remains the central hub for AI advancements and robust corporate earnings,” stated Charu Chanana, chief investment strategist at Saxo Markets.

She highlighted potential in “Chinese tech, where policy backing and monetization are beginning to converge; Japanese banks as the Bank of Japan moves toward tighter policy; and India’s story driven by robust domestic demand.”